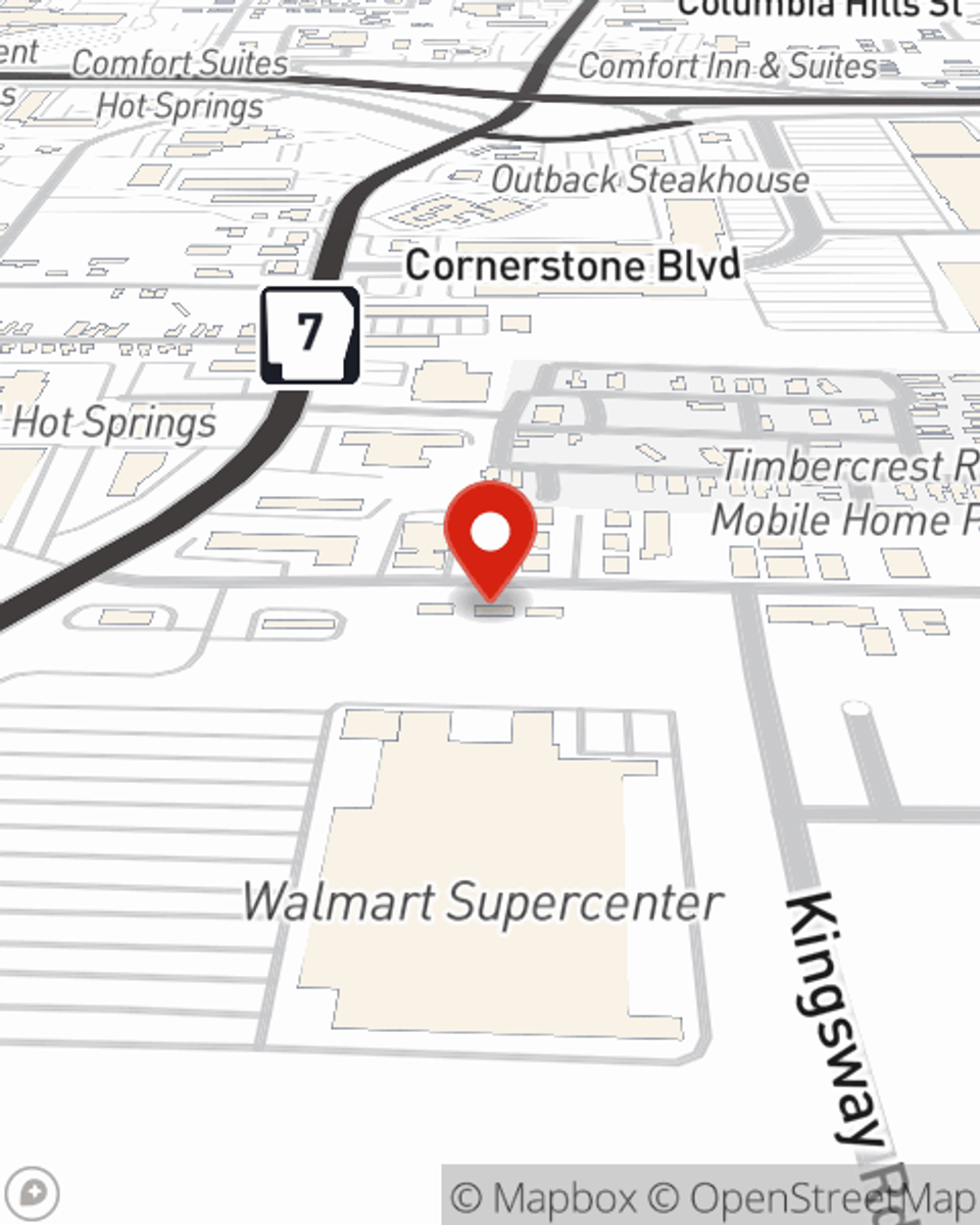

Homeowners Insurance in and around Hot Springs

Looking for homeowners insurance in Hot Springs?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- Hot Springs

- Garland County

- Royal

- Pearcy

- Diamond Head

- Lake Hamilton

Welcome Home, With State Farm Insurance

One of the most important actions you can take for your family is to get homeowners insurance through State Farm. This way you can rest easy knowing that your home is protected.

Looking for homeowners insurance in Hot Springs?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Don't Sweat The Small Stuff, We've Got You Covered.

Your home is the cornerstone for the life you hold dear. That’s why you need State Farm homeowners insurance, just in case trouble comes knocking. Agent Clay Combs can roll out the welcome mat to help provide you with coverage for your particular situation. You’ll feel right at home with Agent Clay Combs, with a straightforward experience to get dependable coverage for your homeowner insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Home can be a sweet place to live with State Farm homeowners insurance.

When your Hot Springs, AR, home is insured by State Farm, even if something bad does happen, your most valuable asset may be protected! Call or go online now and discover how State Farm agent Clay Combs can help you protect your home.

Have More Questions About Homeowners Insurance?

Call Clay at (501) 525-1300 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

The free Ting offer continues to help keep policyholders safe

The free Ting offer continues to help keep policyholders safe

State Farm is offering free Ting Sensor devices to qualified policyholders in participating states.

Radon gas in homes: What to know

Radon gas in homes: What to know

Radon gas is odorless, colorless and the second leading cause of lung cancer. These are some common methods for assessing, preventing or removing it.

Simple Insights®

The free Ting offer continues to help keep policyholders safe

The free Ting offer continues to help keep policyholders safe

State Farm is offering free Ting Sensor devices to qualified policyholders in participating states.

Radon gas in homes: What to know

Radon gas in homes: What to know

Radon gas is odorless, colorless and the second leading cause of lung cancer. These are some common methods for assessing, preventing or removing it.